Does Retirement Timing Matter?

While saving for retirement, you face a lot of uncertainty along the way. Markets continue to go up and down, inflation may go up which reduces your purchasing power. Once you get to retirement you may be worried about outliving your retirement nest egg. One big retirement risk that people often do not consider is sequence of returns risk.

What is sequence of returns risk? This is the risk that comes from the order in which your investment returns occur. To put it another way, sequence of returns risk is the risk that markets are negative in the early years of your retirement. When paired with ongoing withdrawals, this can significantly reduce the longevity of your portfolio. While investors are saving for retirement, short-term volatility does not necessarily matter, but negative returns once someone retires can have a significant impact on their overall retirement financial plan.

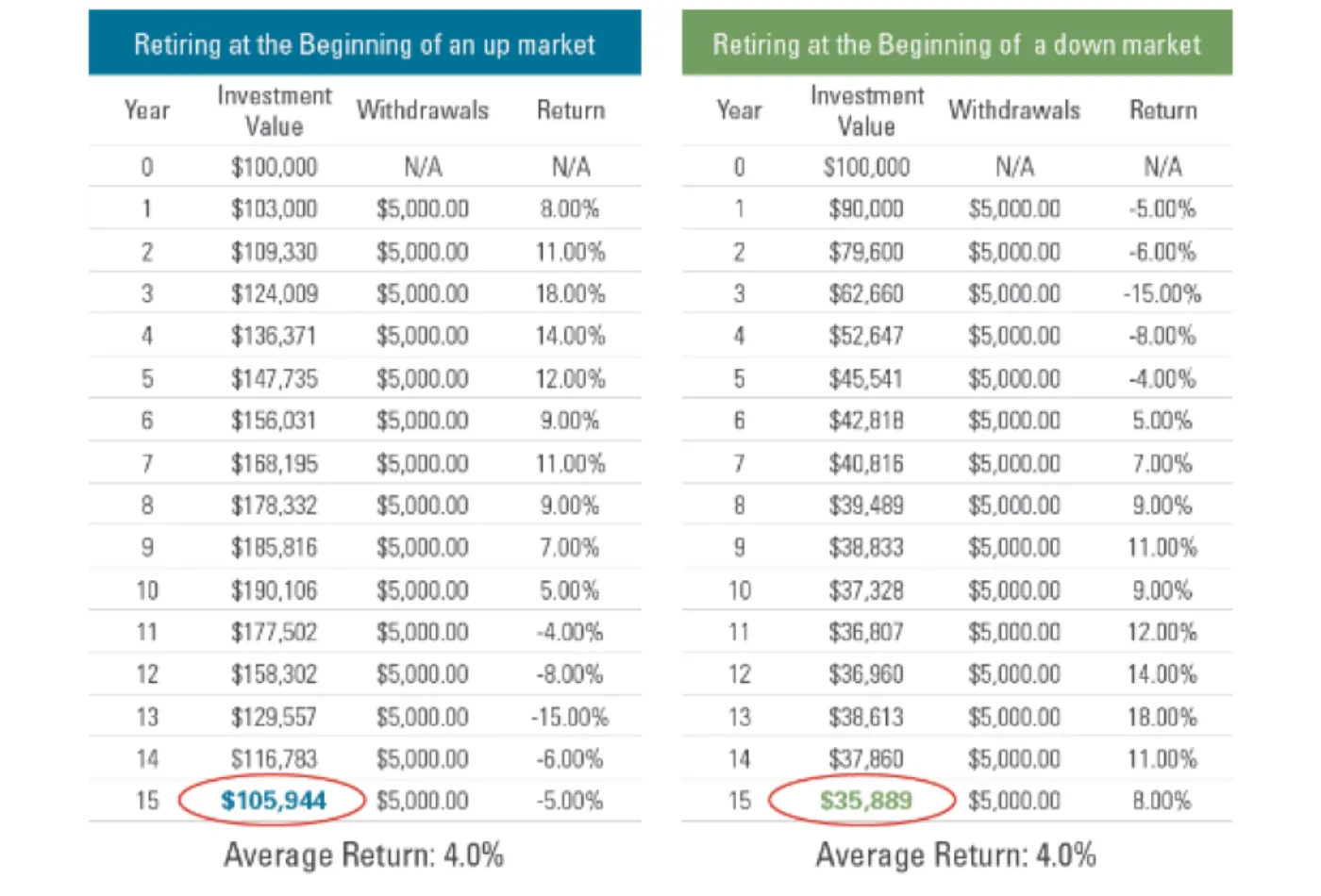

Let's take a look at two hypothetical portfolios to better understand how this can impact you:

In the hypothetical example above, you will notice investor blue and investor green both have the same average return of 4%, starting with $100,000, and withdrawing $5,000 per year. The difference between the two situations is the timing, or the sequence of their returns that they receive over the 15-year timeframe.

Investor Blue: This investor has 10 positive years in a row and then has 5 negative years at the end. This leaves an investment value after distributions of $105,944.

Investor Green: This investor has 5 negative years in a row and then has 10 consecutive positive years. This leaves an investment value after distributions of $35,889.

You will want to be prepared with strategies to help mitigate the sequence of returns risk. One thing to consider is how your portfolio is constructed. While we are in our younger years, it may make sense to have a more aggressive portfolio, but once you transition into retirement you might want to consider reducing some of that risk and build a portfolio that can accomplish both your short-term and long-term goals. Another risk to consider would be to make sure you do not get too conservative too soon, but that is a topic we will discuss at another time.

The next thing to focus on is how important it is to balance maintaining your current standard of living with how much discretionary income you have available. If the market is down when you are starting to withdraw funds in retirement, you may be able to reduce your discretionary spending. If you have a sufficient emergency fund, or other liquid assets available, this could be a great place to withdrawal funds in order to continue with your preferred standard of living

Finally, you will want to continue to work with your financial advisor to monitor and stress test your overall financial plan. The stress test will allow you to plan for the “what ifs” and determine what the potential impact could be, and the necessary steps you might need to take to keep your plan on track. Feel free to reach out to us with any questions you have. We can help make sure that you have an appropriate strategy in place to create a solid financial plan to successfully transition into retirement and stay comfortably retired.

This commentary reflects the personal opinions, viewpoints and analyses of the Seaside Wealth Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Seaside Wealth Management, Inc. or performance returns of any Seaside Wealth Management, Inc. client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Seaside Wealth Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Read More

.webp)

Preparing for the Great Wealth Transfer: Strategies for Beneficiaries

Tariffs and Your Portfolio: What You Need to Know Now

Market Update

25 Things to Consider for 2025

Is the Bear Market Over? 📉🐻