How the Outcome of the U.S. Presidential Election May Affect Your Investments

Right now, the election is top of mind for everyone. The 2020 U.S. Presidential Election has the potential to affect different aspects of financial planning including Social Security, income tax policy and the financial markets. Since it is impossible to predict who will win the election, I want to shed some light on the possible outcomes that may result using history as our guide (because that is all we have!).

We often hear questions concerning the financial markets or the economy if Trump or Biden wins the election?

“The economic consequences of a Donald Trump win would be severe.”

This is a quote from the 2016 presidential election. I share this with you to provide some perspective. The prevailing wisdom of the summer of 2016 was that Hillary Clinton was going to be the next President of the United States. The other concept was that a Trump victory would be bad for the economy and the financial markets. On election night, the futures market was down 1,000 points as it became evident that Donald Trump was going to win. The Wall Street Journal even had an article that said “Stock Futures Plunge as Donald Trump Posts Surprising Win.” That fear didn’t even make it through Donald Trump’s first day in office as the S&P 500 closed in positive territory. The market went on to post 15 straight months of positive returns. The moral of the story is prevailing wisdom can often be wrong.

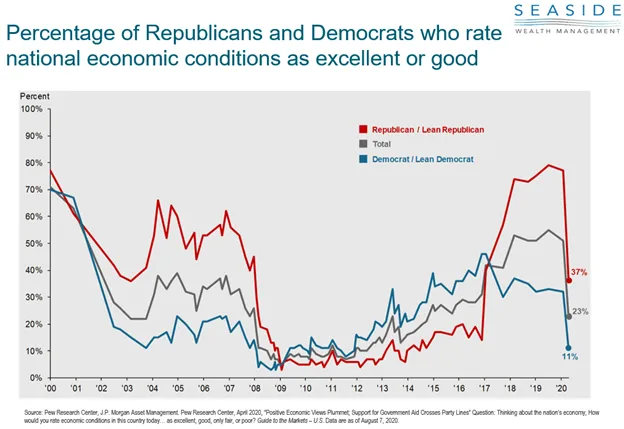

Armed with the knowledge that prevailing wisdom can often be wrong, what can we actually do about it? One thing we always recommend is not letting your emotions drive your decision-making process. The chart above shows how people feel about the economy during different time periods. Republicans (the red line), generally felt good about the economy during the early part of the 2000’s until their positive feelings swiftly changed and pretty much fell off a cliff. A lot of these feelings came from the great Financial Crisis of 2008, but they also coincided with a victory of President Obama in the 2008 Presidential Election and lasted all the way until 2017 after Trump was elected. From a Presidential cycle standpoint, their feelings coincide with the Obama and Trump presidencies. Opposite, Democrats (shown by the blue line) felt less positive in the early part of the 2000’s, but feelings progressed through the Obama years. Is this a coincidence or are the feelings we have about the economy tied more to our political beliefs? What is the moral of all this? We believe you should not let your political leanings impact your investment decisions.

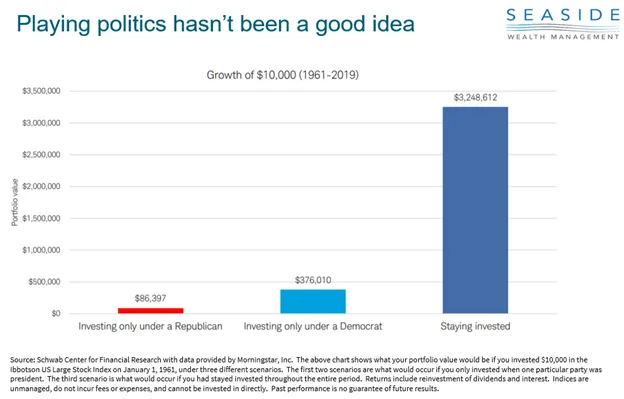

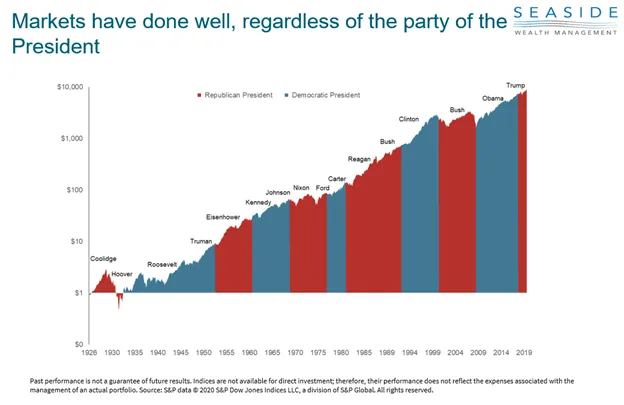

Why shouldn’t you let your political leanings impact your financial decisions? Because if you did, and this goes for both parties, your financial nest egg would have been dramatically smaller. The chart below shows those investors who stayed invested regardless of which president was elected did phenomenally better than those who remained invested only under their party president.

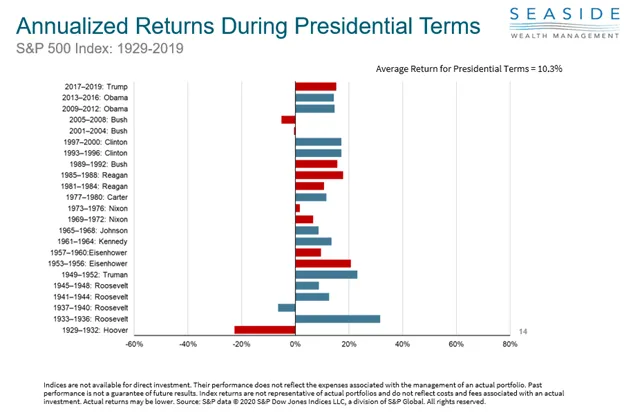

So, let us look at this in more detail. Let’s start with the fact that the annualized return of the S&P 500 going back to 1929 is about 10%. It is a phenomenal return! As an investor do you care if that 10% is earned under a president who is Republican or Democrat? Furthermore, whether Democrat or Republican, one or two terms, the S&P 500 has been positive for most of those presidential terms. Looking at it more closely, there have only been four presidential terms where returns were negative.

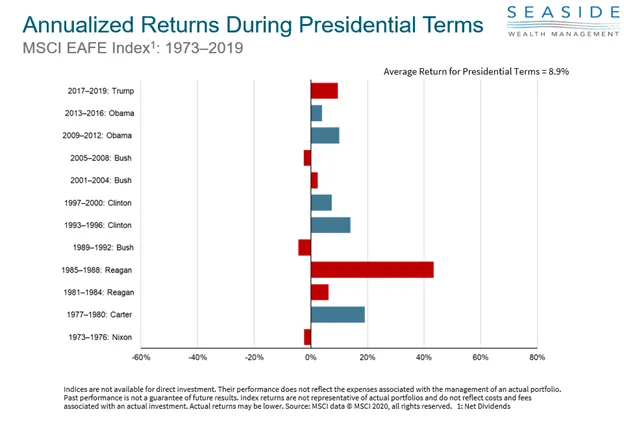

Next, since we believe in global diversification, we wanted to look outside of U.S. returns as well. This chart shows annualized returns for International companies during different presidencies. In doing our research, we have found that the results are similar to the returns of the U.S. with an average return of almost 9% per year for each Presidential term. It is interesting to note that the EAFE (the index for International companies) has only been negative for terms of Republican presidents.

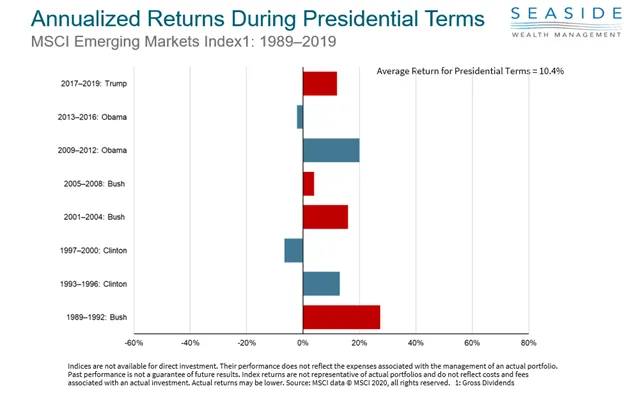

When we look at Emerging Markets there were two Presidential terms where the returns were negative. But, this time both were during a Democratic presidential term. Honestly, our best guess is the negative International returns were more correlated to things outside of who was in the White House and were more affected by currency prices and other variables beyond what a U.S. President can control.

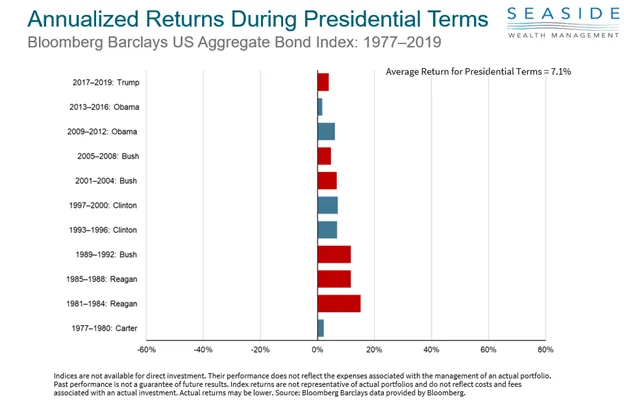

Shifting away from equities, let us focus on fixed income. One thing to notice is that bond returns have been quite high, averaging 7% throughout each Presidential term. It is important to remember that we have seen interest rates drop from the high teens in the 1970’s to near zero today so it is not surprising to see more recent presidential terms show lower fixed income returns. The other item to note is that, unlike equities, there has been no Presidential terms over the time that have experienced a negative return in bonds.

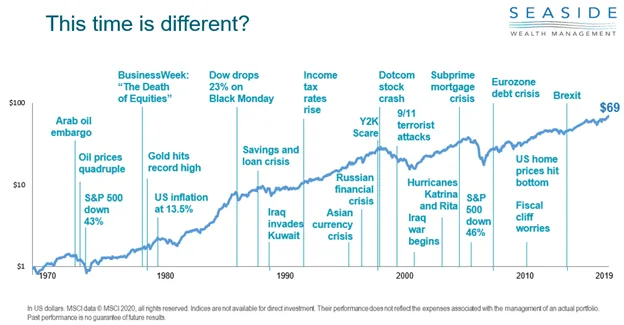

We frequently hear that this election just feels different given the current environment with the economic impact of COVID-19, social unrest, and everything else going on. We would agree that this time is different. In fact, we would argue that the exact circumstances are always different though the outcomes have been similar. This chart shows us the growth of a dollar From the MSCI All World index over a 50-year time period. You can see all the different events including high inflation, wars, terrorist attacks and plain old recessions. While all those felt large and important at the time, the reality is that they have been blips on the radar over the long run. In short, a disciplined investor looks beyond the concerns of today to the long-term growth potential of the market’s tomorrow.

If we pull that timeframe out a little bit further and look at it from the presidential party perspective the chart tells the story of a disciplined investor who has done well by staying invested. You may be asking yourself why is this the case? The reality is that markets are made up of public companies who are required to make decisions that are in the best interest of the shareholders. Whether there are currency crises, changes in tariffs and taxes or some other event, the leadership of these companies adapt to their environment and do what is best to build capital for the shareholders.

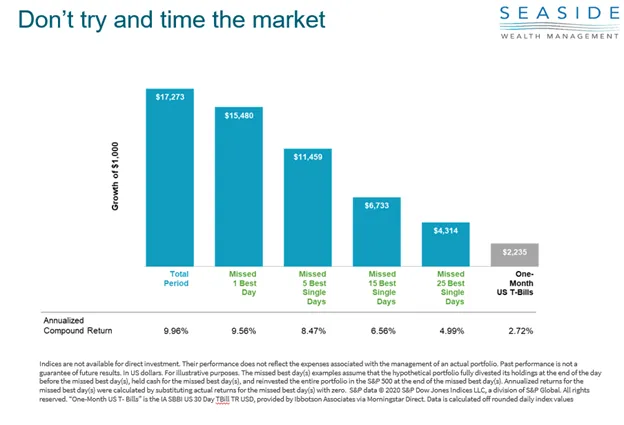

Despite all the data, some people may still be thinking they should go to cash until after the election to see who wins and then reinvest. What is so wrong with that? It is a good question. Our strong preference is to stay invested rather than to try and time the markets. If you try and time the markets, you must be right twice. You have to be right once when you get out and then again on the way back in. The reality is, we do not know anyone who can make those calls correctly with consistency. We also know that missing just a few days of strong returns can drastically impact your long-term performance. If you look at the performance of the S&P 500 from 1990 through 2019 you can see how different your outcome would be if you missed just a few of the best days. These returns can come at any time and may not come together. If you miss them because you were trying to time the market your long-term goals could be severely compromised.

It is completely understandable that many of you will have a strong personal view on politics and what may happen because of the U.S. presidential election. That being said, we strongly caution against making major changes to your portfolio unless dictated by your financial planning needs. Instead, we would recommend focusing on what really matters:

- Financial planning is a process, not an endpoint

- Concentrate on long-term goals and objectives

- Focus on reaching goals, not on beating benchmarks

- Maintain a disciplined approach, in good and bad markets

- Invest broadly and globally; asset allocation is key

- Reduce investment and tax costs where possible

- Rebalance, as necessary

Read More

Smart Money Moves to Make for 2026

26 Things To Consider In 2026

Smart Year-End Money Moves to Strengthen Your Financial Future

What to Do With an Inheritance: Smart Moves for Wealth Preservation

8 Things to Think About as You Approach Retirement