Should I Reduce Risk in my investment portfolio now?

Should I Reduce Risk in my investment portfolio now?

With the recent market volatility and the seemingly endless stream of bad news, you may be wondering if this is a good time to reduce risk in your investment portfolio. The Federal Reserve announced last week that they remain committed to increasing interest rates as long as it takes to get inflation under control. The market reacted poorly to that news. You may be wanting to reduce risk in your portfolio.

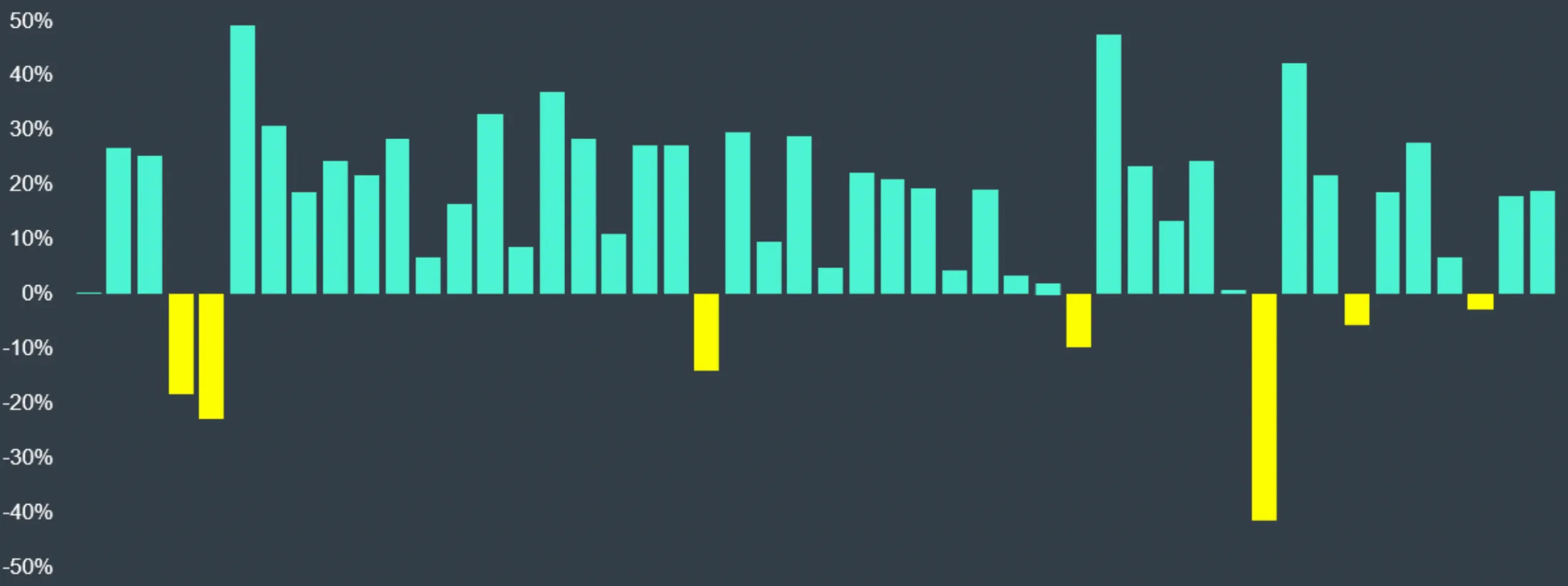

Most investors who jump in and tweak their portfolios typically do it in response to market conditions and history has shown us this just doesn’t work out in their favor. Even though you may be tempted to make adjustments when the market dips, you are better off leaving your investment portfolio alone for the long haul. Downturns happen. In fact, they are a normal part of investing. On average, the market goes down over 10% at least once every single year.

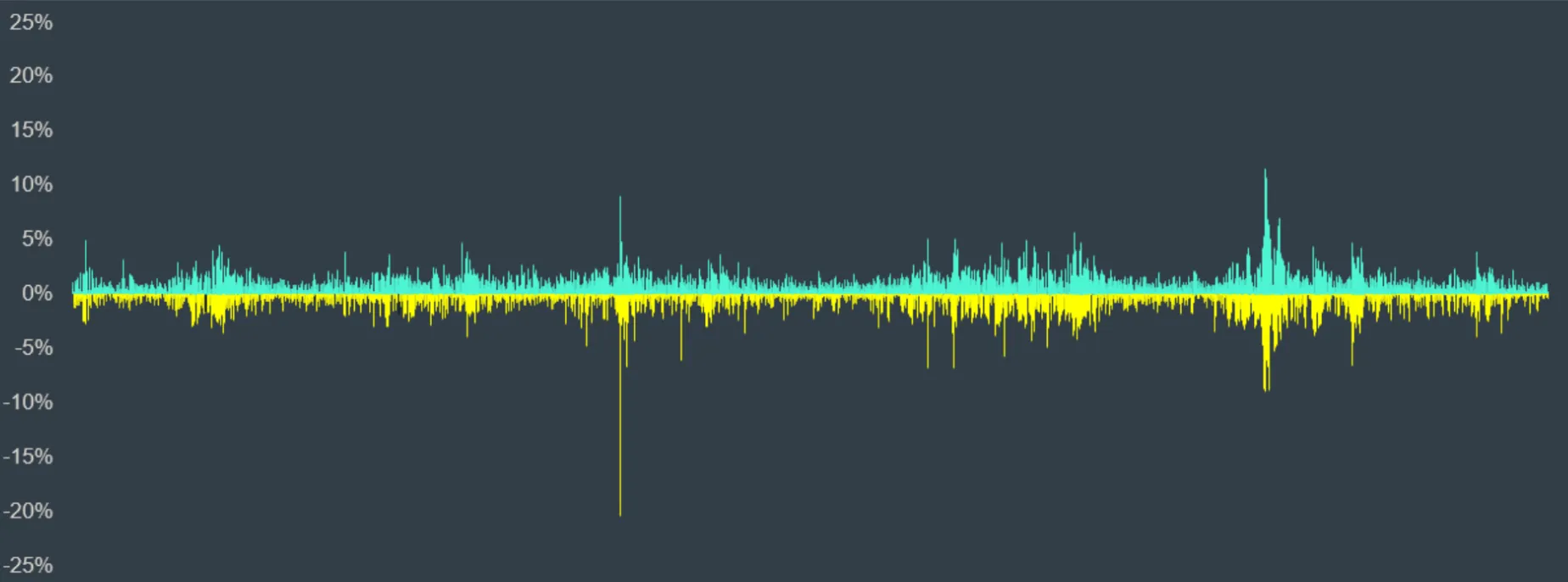

On a daily basis expect the market to be down almost as much as it’s up. The stock market is down on about 46% of all trading days.

Patience and discipline will be rewarded over the long-term. On an annual basis, the market tends to go up most years.

So if you can’t time the market should you ever adjust your asset allocation?

There are actually two good reasons why you should adjust your asset allocation. If retirement is within the next three years, this is a good time to review your asset allocation and make sure it’s appropriate to help you transition into retirement. This may involve reducing the equity portion of your portfolio. Having 60%-70% of your portfolio in equities is pretty effective for a retiree. While there is no “cookie cutter” solution, you want to make sure that you have a sufficient equity allocation in your portfolio to help you fight off inflation and create income over a 30-year retirement.

Conversely, if you have decided to extend your working career, this affords you the opportunity to keep more of your portfolio in equities since you have more time on your side to successfully handle the volatility that inevitably comes with stock market investing.

In either case, you don’t want to manage your allocation based on the whims of the stock market. You should manage your asset allocation based on your personal time horizon and financial plan.

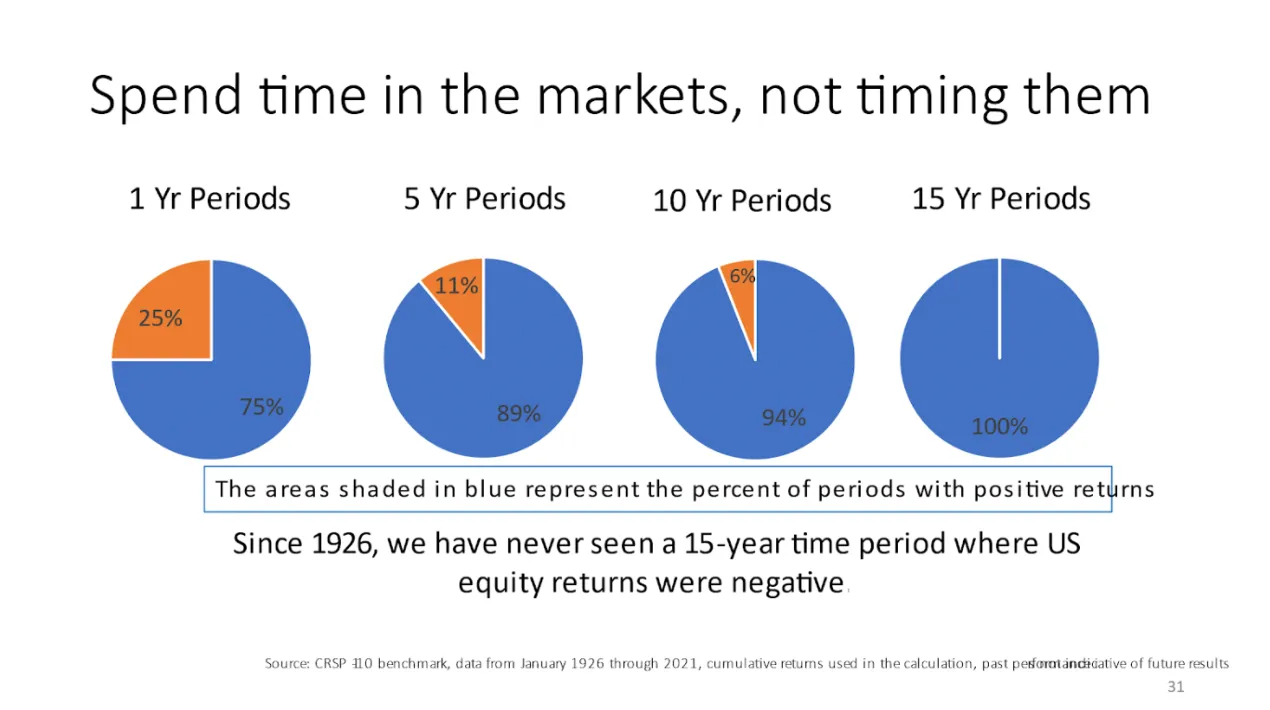

History is on the side of investors who stay invested for the long- term. As the chart shows, U.S. stocks have had a positive return over 10-year periods 94% of the time and have never had a negative 15-year period. Focus on spending time in the markets, not timing them.

If you have questions or concerns or simply would like to discuss your own personal risk tolerance and time horizon, please don’t hesitate to contact our office.

Read More

How Often Should I Meet With My Financial Advisor?

Smart Money Moves to Make for 2026

26 Things To Consider In 2026

Smart Year-End Money Moves to Strengthen Your Financial Future

What to Do With an Inheritance: Smart Moves for Wealth Preservation